What's Important To You, Is Important To Us

Selling or Buying A Home Is A Big Decision. You Deserve The Best… You Deserve The Strange Treatment.

Contact a Strange Team Agent now!

Call: (720) 295 – 4350

Email: info@strangeteam.com

HQ:

11859 Pecos Street, #300

Westminster, CO 80234

North Hub:

3000 Airport Drive, #502

Erie, CO 80516

We’ll Find You The Perfect Space

Come see what we’ve got on the market waiting for you.

We Work With Your Budget

Ask us about or many programs such as financial budgeting, credit repair, how to make your offer more enticing, and so much more, all free of charge as part of our many client services.

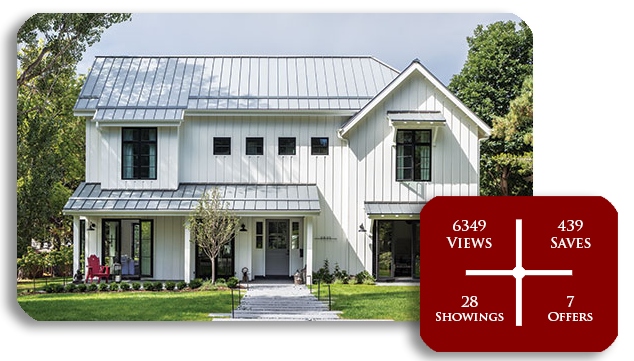

List Your Property & Let Us Do the Rest

The Strange Team has a tried and true method of getting your property sold for the highest price in the least amount of time. Come experience it for yourself.

Current Listings

The Strange Team are experts at finding great listings… priced just right, and prepared to close. Come take a look at what we have right now.

$1,199,000

3,276 Sq Ft. • 5 Beds • 3 Baths

11388 Nucla Street

Commerce City, CO 80022